When you’re building an eCommerce business, you might wonder, “What is it really worth?” Whether you’re preparing to sell, raise funding, or just want to know how you’re doing, understanding how eCommerce companies are valued is essential.

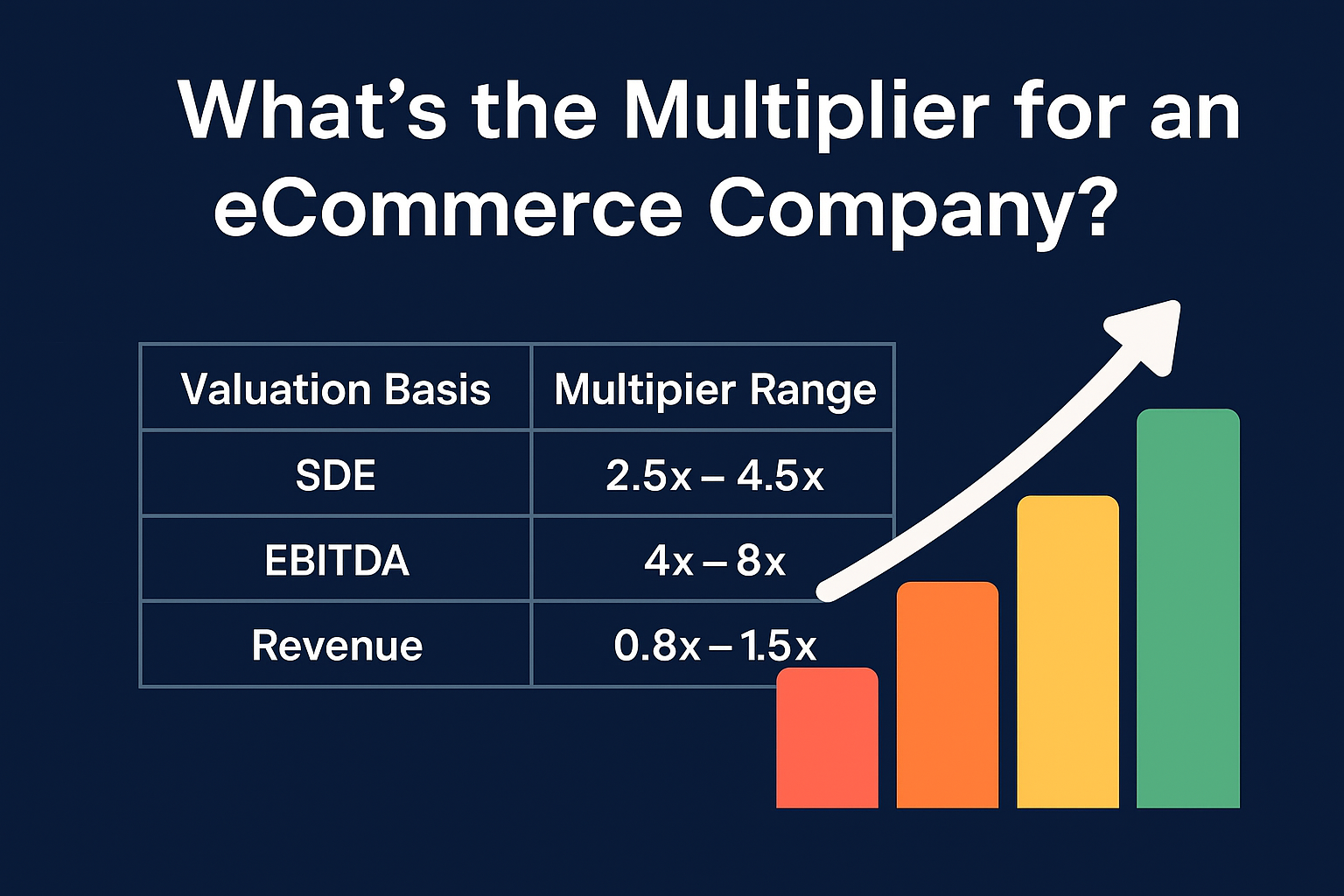

The core of valuation for most online businesses is a multiplier applied to a specific metric like SDE (Seller Discretionary Earnings), EBITDA, or revenue. This multiplier reflects how attractive your business is to a potential buyer or investor.

In this extremely detailed blog post, we will break down the multipliers used for different types of eCommerce businesses, what affects those numbers, and how to increase your valuation.

💸 Common Valuation Multipliers for eCommerce Businesses

| Valuation Basis | Typical Multiplier | Used When |

|---|---|---|

| SDE (Seller’s Discretionary Earnings) | 2.5x – 4.5x | Small to mid-size businesses (<$5M revenue) |

| EBITDA | 4x – 8x | Larger businesses (> $5M revenue) |

| Revenue | 0.8x – 1.5x | High-growth, low-profit businesses |

🔄 What Is SDE and Why Is It Used?

SDE (Seller’s Discretionary Earnings) is the total financial benefit that a single full-time owner-operator would derive from the business.

SDE = Net Profit + Add-backs (Owner Salary, One-time Expenses, Personal Expenses)

For most small eCommerce stores, this is the default metric. It reflects the true profit after removing discretionary or non-essential costs.

💰 What Is EBITDA?

EBITDA = Earnings Before Interest, Taxes, Depreciation, and Amortization.

This is the go-to for larger eCommerce brands, especially those with management teams, multiple shareholders, or institutional investors.

🌍 Why Revenue Multiples Are Less Common

Using revenue alone is rare in the eCommerce world unless the business is growing rapidly but has not yet reached profitability (e.g., startups, VC-funded brands).

Revenue multiples are usually lower (0.8x – 1.5x) and require an attractive brand, product, or technology play to justify.

🧐 Key Factors That Influence Your Valuation Multiplier

1. 📅 Age of the Business

Older businesses (2+ years) show sustainability and reduce buyer risk.

2. 🧠 Profit Margins

A business with 20-40% net profit margins gets a higher multiple than one barely breaking even.

3. 🌐 Traffic Sources

- Organic traffic = High multiplier

- Paid-only traffic = Lower multiplier

- Email list traffic = Valuable recurring asset

4. 📄 Operational Efficiency

- Automated fulfillment = higher value

- Documented SOPs = attractive to buyers

- Use of a 3PL vs. manual shipping

5. 📆 Seasonality

Seasonal brands (e.g., swimwear) usually get a discount unless they have strong year-round cash flow strategies.

6. 📠 Branding

Strong brands (with loyal followers, memorable names, and a unique look) can increase multipliers by 0.5x–1x.

7. 🚀 Growth Potential

A business that’s trending upward with clear growth levers (e.g., SEO strategy, new products, international markets) gets better offers.

👩💼 Example Valuation Scenarios

✅ Example 1: Mid-Level Apparel Brand

- SDE: $100,000/year

- Strong email list and organic traffic

- 3 years old, diversified SKUs

- Estimated multiplier: 3.8x

- Valuation: $380,000

✅ Example 2: High-Growth Dropshipping Store

- EBITDA: $500,000/year

- Facebook ads only

- 18 months old

- Estimated multiplier: 3x (risk due to reliance on ads)

- Valuation: $1.5 million

✅ Example 3: Branded Health Supplement Store

- EBITDA: $1.2M/year

- Subscription-based, excellent LTV, strong SEO

- 5 years old

- Estimated multiplier: 6.5x

- Valuation: $7.8 million

⚖️ How to Increase Your eCommerce Valuation

- Build Recurring Revenue: Subscriptions, memberships, or auto-ship products increase predictability.

- Diversify Channels: Use SEO, Pinterest, YouTube, TikTok, and email—not just Facebook Ads.

- Automate Operations: Outsource fulfillment, support, and content.

- Document Processes: SOPs make it easier for a buyer to take over.

- Improve AOV and LTV: Use bundles, upsells, loyalty programs.

- Clean Financials: Separate personal expenses, hire an eCommerce bookkeeper, use QuickBooks or Xero.

🤔 FAQ: What Is the Multiplier for eCommerce Companies?

📊 What is the average multiplier for small eCommerce stores?

Answer: Typically between 2.5x and 4.5x SDE. Higher if you have great branding, traffic, and repeat customers.

🏦 Should I use SDE or EBITDA?

Answer: Use SDE if you’re a solopreneur or small brand. Use EBITDA if your store generates $1M+ in profit or has a full team.

🤑 Do Shopify stores sell for good valuations?

Answer: Yes. If your store has clean books, branded products, and reliable profit, Shopify stores can sell for great prices.

🫱 Can I sell a dropshipping business?

Answer: Absolutely. You need at least 12 months of consistent profit, a brandable store, and automated systems to get a decent valuation.

💳 What if my store is new but fast-growing?

Answer: You may still get a buyer, but expect a lower multiplier. Growth and brand story are key selling points.

🎉 Final Thoughts

If you ever wondered what is the multiplier for eCommerce companies, now you know—it’s more than a number. It’s a reflection of how healthy, scalable, and desirable your business is.

Want to boost your valuation? Focus on profits, automation, branding, and recurring revenue. You don’t need to be a massive company to command a strong multiplier. You just need a smartly-run business.

Whether you’re preparing to sell now or just want to track your net worth, start optimizing today—because every tweak you make can mean thousands more tomorrow.